Martin McCudden Dip PFS, Cert CII(MP), Financial Adviser

Financial Advisers Agents in Rhyl

Hyde Park

Kinmel Bay

Rhyl

Clwyd

LL18 5FN

Contact Numbers

Mobile: 07971 1... 07971 169607

Websites

Social

Opening hours

Monday to Friday: 9am - 5:30pm

Saturday to Sunday: Closed

Key Services

About

- Areas Covered - North Wales, Rhyl, Prestatyn etc

- Pensions, Investments, Mortgage, Wealth Management

- See website for customer reviews

- Sound Financial Planning for everyone

- Holistic Financial Planner

- 20 Years Experience

- Multiple payment options offered

- Free Initial Review to discuss needs

Financial Planning with your Financial Adviser

I am a Financial Adviser within a Partner Practice which is an appointed representative of St James's Place Wealth management, a FTSE 100 company and provide financial advice to personal & business clients with regards to Investments, Pension planning and other financial services needs. We have an office in St Asaph to conduct client meetings, and serve individuals and businesses across Mid and North Wales.

Advice Area's -

- Investments

- ISA's

- Wealth Management

- Pensions

- Mortgages

- Life Assurance

- Business Protection

In the recent light of the big banks making their financial advice wings redundant, you may find yourself in the worrying situation of investments with the bank and no adviser to guide you through the stormy waters given the recent Brexit vote to name but one.

The advice available can range from straight forward life insurance for the family and to financially protect your loved ones or to cover the mortgage debt, to more complex needs such as pension or investment and wealth management planning whether it be on a personal or business basis.

Complex estate planning is also available such as trusts, wills or inheritance tax mitigation. Many other needs can be met, such as arranging your mortgage or considering a re-mortgage to lower payments or release funds.

The initial consultation is free and there's no obligation. Even if it's just an initial review....perhaps you have only ever bought bank products and now they don't even look after you ! There's a whole other world out there where your adviser can work for you and not dance to the tune of the bank or insurance company, give me a call, you may be pleasantly surprised .

A Beginners Guide to Life Insurance......

Life insurance or to give it some of it's other names, life cover, term cover, term life insurance, is one of the most purchased types of life insurance when it comes to family protection. Life cover forms the bed rock of any foundation when it comes to protecting the family in the event of death of one of the parents. Don't think for a second that just protecting the breadwinner is all you need to do. Of course that's important but if one of the parents or guardians is a non earner then you can bet they're still working. School runs, house cleaning, shopping, washing, ironing, feeding and the list goes on. So if you're in the market for cheap life insurance or shopping around for life insurance quotes well consider both parties when you compare life insurance.

So what's it all about and how does it work? Well, the plan runs for a finite term, hence the name, and the choice of that term is up to you. A term could be anything from 18 to 85 years of age. The idea of life insurance is not so that the grieving spouse can profit from their partners death, but so they have funds to alleviate the financial burden of that death. Popular periods where people look to cover themselves could be the period when the children are growing up or through unto a retirement age. For example, you may have two lovely children age 3 and 7. It might be that you choose life cover with a term of 18 years, Why ? Well in 18 years time the youngest of the children will be 21 and hopefully just finishing university and the older one will already be through university. It may be you choose cover beyond this, the choice is yours. Remember however, the more life insurance cover you have and the longer the term the more expensive it will be.

How much cover should I have ? Well again the choice is yours, but if you need a little help then try our calculator on our sister site GenieInsurance.co.uk which specifically deals with Protection Insurance.

Life insurance can be provided for single, joint or even dual cover. A claim on a single plan would have no effect on anyone else's cover, whereas a joint plan would cease entirely after the first event or claim or death and the other named person on the plan would be left with no cover. A dual plan offers two separate individual covers built within the same policy, just like having two single plans but one premium.

Your life insurance can be level or index linked so it rises each year to keep pace with inflation but bear in mind your premium may also rise each year. You can build in extra benefits like critical illness or waiver of premium benefit or premium protection benefit as it is sometimes called. This pays the monthly plan premium during times of sickness from work.

Another thing to bear in mind is that you might feel you don't want a lump sum paid out in a single go and would rather it paid each month like an income. This can be accommodated for and in the industry this type of policy is often referred to as family income benefit, see here.

One final consideration. It's well worth considering that you put your life policy into trust. Besides other things, this helps to ensure that any benefit after your death is paid out speedily to who you want it to go to. Most of the insurance companies provide guides and forms free of charge to allow you to put your plan into trust. If you're unsure seek professional guidance from a solicitor

Critical Illness Cover ..... what's that then ?

Critical illness insurance or critical illness cover, or indeed even critical illness protection all started life in way off South Africa. The year was 1983 and it went by the name of dread disease insurance, serious illness insurance or trauma insurance. More of that little story in a minute. Some companies even give the cover a pet name such as Living Assurance or LifeChoice. This is their way of giving the cover a name that more closely resembles what it is and what it does. I'll refer to it in any of it's above guises in this, my 'Life Insurance for Life' critical illness info guide.

No matter what they call it, it's essentially the same thing from whoever you buy it from. It pays out upon surviving a set time after being diagnosed with an illness that is covered by your plan. The ‘set time' I've just referred to with regards to critical illness insurance can be anywhere between 8 to 30 days or somewhere in between. So for instance, your policy may say ‘pays out the sum assured upon diagnosis of one of the critical illnesses contained on your policy after survival of 14 days'. That said however, the amount of critical illnesses contained on a critical illness policy can vary from company to company. It's fair to say though, that almost every company offering critical illness insurance cover the big three, those being, heart attack, cancer or stroke which accounts for nigh on 80% of all claims paid out, closely followed by neurological critical illnesses such Multiple Sclerosis.

Beware however, some companies may cover a huge array of 40 or more critical illness definitions but will you ever be diagnosed with ‘red mountain goat disease'? You need to look closely at the Key Features document or brochures that the company produces as these will contain all the definitions. It may also be that you have two companies each offering critical illness protection for cancer cover. Cancer can be a very broad illness with a bewildering degree of different types of cancer. Look closely and compare life insurance companies definitions. The devil is in the detail as they say. It might be that one company's definition of cancer is that little bit fairer than another company's and that the cancer doesn't need to be as invasive or widespread for that company to pay out. Most cancers however have to be more than just a freckle that can be chopped out on a day trip to the local clinic!

Another classic definition might be a critical illness protection plan that pays out if you have triple bypass surgery whereas another pays out it's critical cover if you have just double or single bypass surgery so a keen eye for detail here helps. With more help regarding definitions please have a look at the independent website of the Association of British Insurers (ABI) www.abi.org.uk and there you can also find an extremely informative document showing their standardisations and definitions of illness and best practice. The direct link to the pdf is here http://www.abi.org.uk/Media/Releases/2011/02/54762.pdf.

Remember critical illness cover costs can vary and it can well be that you get what you pay for. Far more so than just life cover where if you're dead, your dead...they don't ask that they wheel in the body as proof!

Critical illness is often viewed as a bolt on to life insurance and it's true that it can be added to a life insurance plan so that the plan pays out on the earlier of either death or a critical illness. It can however be set up so that the plan pays out in the event you suffer a critical illness and then pays out again at a later date if you die. It can be set up with the same amount of critical illness as life cover or you can vary the amounts if you feel the bolt on critical cover is too dear. Eg your plan may contain life insurance of £100,000 but critical illness insurance of just £25,000 if you feel that's enough to see you through a period off work whilst you're getting better or house modifications or paying for your own private medical help. The choice is yours and the plans can be adapted to whatever suits you depending of course on the flexibility of the company offering the critical illness insurance.

The critical illness plan itself can also have additional cover that is either integral to the plan or can be bolted in such as children's cover or buyback cover or total and permanent disability benefit or TPD for short. This can be a vital add in, but again read the small print when it comes to definition or check the ABI website above. Does it pay out on own occupation , any occupation or suited occupation. Very important differences.

A few final warnings for you. The doom mongers and cynics might say, ‘critical illness cover never pays out' . Well that's untrue. A major broker last year confirmed payouts by the British insurers had risen to over 90% , that's more than 9 out of ten claims paid ( Source: LifeSearch claims statistics report ). In 2011 alone, one major insurer (Legal & General) paid out over £177 million pounds in critical illness claims (Source: Legal & General Claims Department 2012, based on critical illness and death claims finalised in 2011). One of the main reasons in the industry for this, is a reduction in non disclosure by people applying for the plans. Don't think you can just tell fibs when you fill in an application and pretend you're a non smoker then smoke 50 a day until you get lung cancer. They simply won't pay. They might be a little more sympathetic if your non disclosure is innocent, ie you forgot to tell them that you had childhood asthma that cleared up when you started secondary school etc, but don't take the risk. If unsure, disclose it. Tell them everything on your application. Don't give an insurer any chance to wriggle out of a future critical claim just at a time when you really need the money.

Another thing to watch out for is thinking you already have the cover on your life insurance plan. Let me explain. Many people have told me, ‘Oh, I have critical illness cover on my life plan'. Upon closer scrutiny the benefit they actually have is Terminal illness benefit. This has nothing to do with critical illness cover and is very often just bolted onto a life insurance plan for no extra cost. It basically pays out the life insurance if the doctors determine that you will definitely die within 12 months. All they're doing is paying out the life cover early. Remember, critical illness pays out on diagnosis of a specified illness, it doesn't necessarily mean you are going to die. In fact the whole idea of critical illness benefit is to give you a cash injection just when you need it most so you can concentrate on getting better without the financial worries. You'll get better a lot quicker sunning it on a luxury break to convalesce in the Canaries than a cold weekend in Clacton or Blackpool!

Another oft seen mis-conception is that the benefit pays out if you can no longer work. It may well be the case that your critical illness does stop you working but it has absolutely no bearing on whether the plan pays out or not. If you want protection that pays out if you cannot work then you need to be looking at Permanent Health Insurance or Income Protection Insurance. Think about it, a lot of people keep on working even with cancer. It's just their way of dealing with it.

So, after all that, back to South Africa. You may be familiar with the man who was involved in the worlds first ever human heart transplant surgery in 1967, Dr Marius Barnard, a South African cardiac surgeon. He noticed over the years the devastating effects financially, that a critical illness can have and many years later he lobbied the south African insurance companies to literally invent an insurance that would pay out for a critical illness. They called it dread disease insurance and on the 6th October 1983 the worlds first critical illness policy was launched.

It's all a matter of Trust

Only a very small percentage of people write their policies in trust. Do you have a life policy and is it written in trust? Let me take you through some of the reasons why this is one area you need to be clued up on. The advantages far outstrip the reasons not to do it and usually it's totally free.

So why doesn't everyone have their policy in trust?

Perhaps laziness, apathy or for whatever reason it just didn't happen, there could be a million reasons, we're human after all. Remember advisers are paid for sorting out your insurance plan, so If the sale is an advised sale then they should be pulling out all the stops to make sure that not only have they researched and gave you the right policy, but they've considered the need for it to be in trust and made recommendations and helped you to put the policy in trust. Advice is what you're paying for after all, is it not?

So what's the big deal?

Alright, let's do it this way, meet Joe. He is married with two children, one belongs to his wife's previous relationship and one between them and he also has a child from an earlier relationship. They are all loved equally of course. He hasn't got around to doing a Will with his new wife but they've chatted about it and all the good intentions are there.

Being the caring dad he decides to buy a life insurance policy at his local bank. It might possibly be a little on the expensive side but hey ho, at least he has some cover. For whatever reason the adviser doesn't bother putting the policy into trust for Joe or showing him the advantages of doing this. It is mentioned on page 12 of the suitability letter but Joe had lost the will to live by page 4 and has missed this pearl of wisdom. No problem, it will go live sooner and Joe will be covered and his adviser will get their commission.

One night on returning home from work Joe is killed. That's how it works by the way, no-one ever plans it or we would just take out life insurance a week before it's needed.

There's no Will, so Joe dies intestate (the legal term for a person dying with no valid Will) and the court decides how to sort out his estate including any money from his life insurance policy. Mrs Joe is distraught but with the help of friends and family manages to struggle through financially..... just, whilst the courts determine how Joe's estate should be divvied out. She finds the cash to bury him from a whist drive at the legion and waits patiently for the courts to do their thing. Uncle Dave helps out with all the forms that arrive from the taxman and every other public body which are suddenly interested in dead Joe. More time goes by and the account at the bank is now in the red. More stress and worry at an already anxious time. Weeks and weeks later the Courts decide how Joe's estate should be divided. Mrs Joe is not happy. This is not what dead Joe wanted at all. What can she do about it now??? Almost nothing at all.

So what could Mr Joe have done better?

He could have put the policy into trust ,Why? The funds would have fallen outside of Joe's estate and thus potentially avoided the tax man. The trust form would have told the insurer who to give the money to and in what proportions. All the children or Mrs Joe would have received within a very short time exactly what Joe had intended. She'd of had funds in the bank quickly to help with the costs of the funeral and other expenses and how much would this wonderfully clever legal trust thing cost him? Nothing, nada, zip, totally free of charge, gratis

The insurers we use all offer the forms free and some have excellent booklets and brochures to help you fill them out as well as helplines you can phone. If you are unsure seek the help of a solicitor or ask your Independent Financial Adviser.

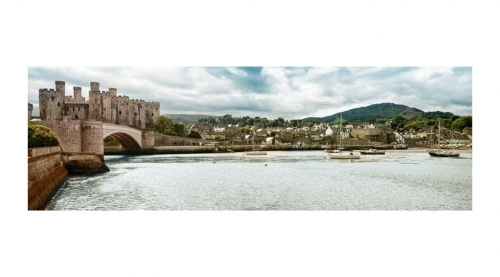

Covering - North Wales

Mainly my clients lie in the belt across the North Wales coastal towns of Llandudno , Conwy , Rhyl , Prestatyn, Abergele, Rhuddlan, Towyn, Kinmel Bay, Bangor, Colwyn Bay, Old Colwyn and inland to St Asaph, Denbigh, Mold, Chester & Ruthin.

Find Us

Office No.2 Hanover House The Roe St Asaph LL17 0LT Coming from the West, you drop off the A55 at St Asaph Jnct 27 and as you go round the roundabout to head into St Asaph, Hanover House is about 150 yards on the left as you leave the roundabout. Althoug

Reviews

There are currently no reviews for this company

Leave your review of Martin McCudden Dip PFS, Cert CII(MP), Financial Adviser

All fields are required. Your review will appear immediately.

Products and Services

Investments & Wealth Management

Investments & Wealth Planning

Wealth Management •Ethical investments •Investing for income •Investment trusts •ISAs •OEICs •Offshore investments •Socially responsible investments •Unit trusts

Pensions & Retirement Planning

Pensions & Retirement Planning

•Annuities •Auto enrolment •Pension consolidation •Pension drawdown •Pensions & divorce •Retirement planning •Pensions transfer •Sipps •Workplace Pension

We offer these services

- Wheelchair access

- Free Parking

- Customer Toilets

We offer these payment methods

- American Express

- Cheque

- Delta

- MasterCard

- Visa

- Bank Transfer

- Direct Debit

- Standing Order

Testimonials

Having worked in financial services in the past, I had a choice of former colleagues to approach when I wanted to make changes to my private pension provision. Martin was my adviser of choice and even I was surprised by Martin's technical knowledge, which highlighted just how far my own knowledge had fallen behind. Dealing with an ex colleague could be difficult for some but Martin was able to pitch things just right, by anticipating where the gaps in my knowledge would be and then advising me accordingly. I have recommended Martin to others in the past and will have no hesitation in doing so in the future.

Ian David Vaughan Prestatyn

I have known Martin for a number of years, but this is the first time I have needed advice on my pensions, I contacted martin and was very pleased with the help and advice I received, Martin sorted everything out for me, I would not hesitate in using Martin again and would recommend his services to anyone.

Jeffrey Hughes Rhyl

Testimonials are added by the business owner and are not independently verified.